Nairobi, August 2025 — Kenya’s consumer economy is entering a pivotal phase. The latest NielsenIQ East Africa Consumer Outlook unveils a marketplace marked by steady economic recovery, selective spending, growing brand mobility, and the rising power of digital influence. Combined with insights from top industry leaders in marketing, retail, and sustainability, the picture that emerges is of a market abundant with opportunity—but one that demands agility, cultural fluency, and strategic foresight.

Economic Momentum Meets Consumer Caution

Kenya’s GDP growth continues to outperform the Sub-Saharan Africa average, with East Africa remaining the fastest-growing region. FMCG value growth is at 11%, largely driven by inflation, yet modest volume gains suggest a cautious return in consumer confidence. Despite this, nine in ten Kenyans believe they are living through a recession, a sentiment shaping consumption habits across age groups.

Gen X is the most financially restrained, focusing on essentials and bulk buying, while Millennials are highly promotion-driven. Across all generations, rising food prices, economic uncertainty, and job security rank as the top concerns for 2025.

Shifts in Spending, Saving, and Brand Loyalty

Households are channelling more of their budgets toward education, healthcare, and groceries, while reducing spend on discretionary items like entertainment, electronics, and dining out. Brand loyalty is fragile—two-thirds of shoppers switched brands in the past year, with essential goods like cooking oil, laundry products, and milk most affected. Consistency in product quality and strong brand trust remain the most effective loyalty anchors, especially among Millennials and Gen X.

Savings patterns are also evolving. While banks retain their dominance, mobile app–based savings platforms are quickly gaining traction with Gen Z, signalling a decisive move toward digital-first personal finance.

The Digital Commerce Imperative

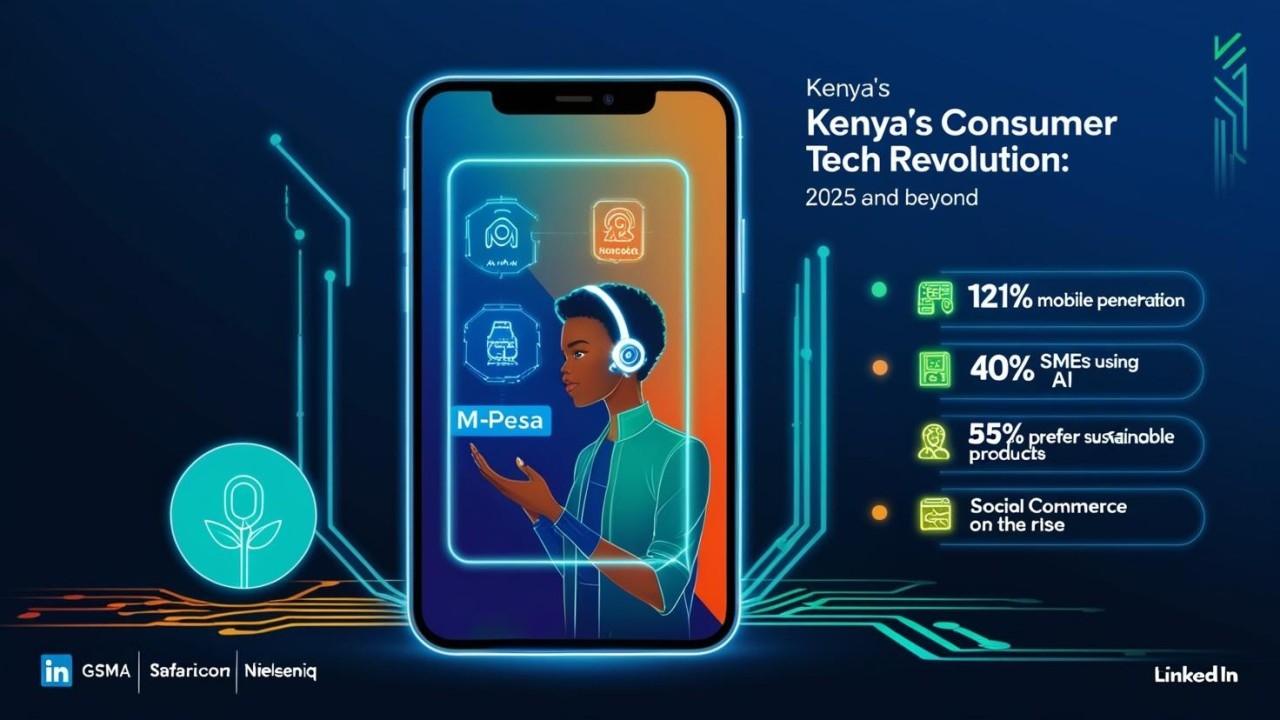

Social media has become a powerful driver of purchase decisions. Twenty percent of Kenyans say their buying choices are influenced by social platforms—led by TikTok, which commands exceptional engagement among Gen Z and Millennials. Clothing and electronics top the list of social-commerce purchases. Meanwhile, 35% of Kenyans shop online, with adoption significantly higher among younger generations.

Artificial Intelligence is also entering the consumer toolkit, with 11%—mostly younger shoppers—using AI to compare prices and gather product information before making a purchase.

Retail Channels and Local Loyalty

Traditional trade still dominates, representing over 60% of FMCG volume, but modern supermarkets are increasingly preferred by younger shoppers. A decisive 89% of consumers express a preference for local brands over international ones, signalling that even global players must localise to remain competitive.

Sustainability as a Market Differentiator

With 71% of Kenyans prioritising eco-conscious and socially responsible brands, sustainability is no longer a niche aspiration but a strategic necessity. Products that combine performance with environmental responsibility are poised for greater market penetration and loyalty.

Leaders Defining the New Consumer Era

The NielsenIQ panel featured industry pioneers shaping the next chapter of East African commerce:

- Prudence Mutembei — Senior Brand Manager, Beers at KWAL (Heineken Beverages), leading Heineken’s re-entry into Kenya with a bold, youth-driven market strategy.

- Francis Karugah — Vice President at IndaHash, redefining brand engagement through influencer marketing at scale.

- Willy Kimani — Founder of Jaza Discounter, transforming retail through operational precision, technology, and global best practices.

- Valyne Kinya — Communications Officer at EPROK, championing sustainability through responsible e-waste advocacy and digital engagement.

The 2025 Success Playbook

Brands that aim to win in this evolving market must:

- Deliver uncompromising quality while remaining price-competitive.

- Leverage social commerce and influencer ecosystems to secure younger audiences.

- Embed sustainability into both product design and brand positioning.

- Integrate traditional and modern trade strategies to achieve full market coverage.

- Harness AI and digital tools to enhance consumer experience and value perception.

Kenya’s 2025 consumer landscape is a complex balance of caution and ambition. For brands willing to innovate, localise, and lead with trust, the market offers not just resilience—but a path to sustained growth and market leadership.