The Centre for Agricultural Transformation (CAT) and NBS Bank plc have signed a Memorandum of Understanding (MoU) to enhance agricultural productivity, technology adoption, financial inclusion, and market access for smallholder farmers in Malawi.

This collaboration will leverage the expertise of both institutions to support crop diversification, increase farmer incomes, and advance the growth of Malawi’s agricultural sector.

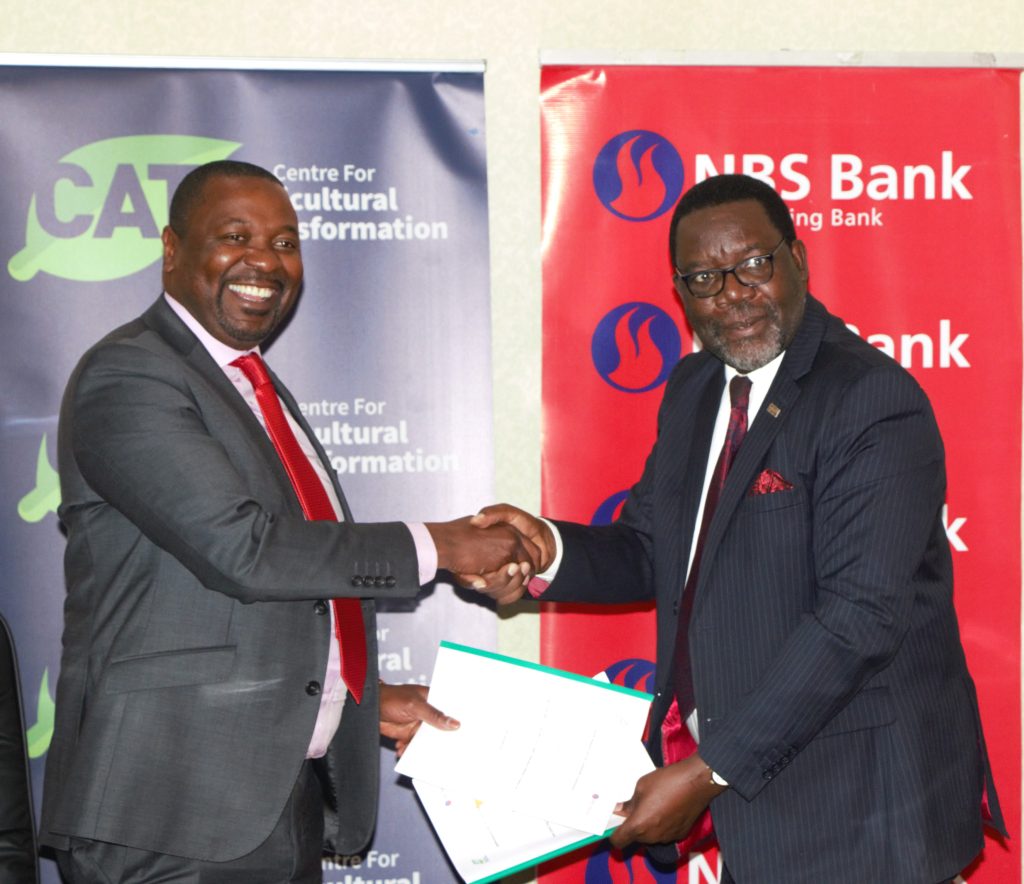

During the signing ceremony held at the NBS Bank Offices in Lilongwe last week, CAT Executive Director Macleod Nkhoma emphasized the significance of the partnership in transforming smallholder agriculture in Malawi.

He stated, “This partnership is a significant step towards transforming smallholder farming in Malawi. To develop the agriculture sector, we need such collaborations to support our smallholder farmers.”

NBS Bank CEO Dr. Kwanele Ngwenya highlighted that the MoU marks a major advance towards achieving an inclusively wealthy and self-reliant Malawi by 2063. He said, “Let’s focus on inclusivity, sustainability, and shared prosperity to create opportunities for farmers, providing them with the resources, knowledge, and support needed for growth.”

Dr. Ngwenya also noted that NBS Bank will play a vital role in offering tailored financial products to commercial farmers, medium-scale farmers, agribusinesses, and smallholders.

“Our goal is to design financial solutions that meet the unique needs of our agricultural clients, empowering them to invest and expand their operations,” he explained.

The partnership will involve several initiatives, including expanding land at CAT-Bunda Smart Farm for technology demonstrations, farmer training, and irrigation development; providing tailored financial products for farmers and agribusinesses; linking farmers with suppliers and markets; conducting value chain research; sharing knowledge through publications and conferences; and joint resource mobilization efforts.

It is expected the partnership will positively impact over 30,000 smallholder farmers by improving their knowledge and skills, enhancing financial empowerment and market access, adopting innovative agricultural technologies, diversifying crops, increasing incomes, and contributing to the overall growth of Malawi’s agricultural sector.

CAT is a centre of excellence in agricultural science, technology, and market systems which helps Malawian smallholder farmers make data-driven decisions for better livelihoods. On the other hand, NBS Bank is a leading retail and corporate bank in Malawi providing comprehensive banking services and aims to become Malawi’s top food and agribusiness bank.